The Labor Code guarantees an employee hired under an employment contract to retain a place for him during the period of illness, as well as payment of compensation for this period - temporary disability benefits. The calculation of the sick leave, as well as the procedure for processing the payment, has its own specifics.

Basis for calculating sick pay

Initially, an employee who falls ill is put on absenteeism in the time sheet. Upon returning to work, the employee provides the personnel department with a sick leave received in a medical facility. In this case, the employer should not forget that the sheet is a document of strict accountability, which serves as the basis for calculating compensation for the period of illness of the employee. On its basis, the employer will then be able to reimburse the amounts paid at the expense of the FSS. Of course, only a genuine sick leave certificate filled out in accordance with all the rules for its execution gives the right to compensation for payments from social insurance.

Recall that medical workers of institutions with an appropriate license for medical activities, as well as for some additional services in the field of medicine, have the right to issue a sick leave. The document must indicate the name of the institution that issued it. In addition, the date of issue of the sheet, the full name of the patient, his date of birth and the reason for temporary disability are required, which is indicated by a special code, the decoding of which is given on the back of the sick leave. The exact name of the employer is also indicated on the sick leave.

However, the medical organization does not fill out the sick leave in full. The rules for calculating sick leave in 2017 imply that the employer himself fills out part of the document. In the FSS, the sick leave must be submitted completely filled out.

After receiving a sick leave from an employee, the employer has 10 calendar days to calculate temporary disability benefits. The entire amount due must be paid on the next day set as the day for calculating wages (part 1 of article 15 of the Federal Law of December 29, 2006 No. 255-FZ).

How sick leave is calculated in 2017

The procedure for calculating the sick leave in 2017 remained the same, and the formula is the same as in previous years. The only difference is that the minimum wage, if it is used to calculate sick leave, has increased since July 2017, and, accordingly, payments based on the minimum wage have also increased.

The total amount of sick leave paid to an employee is determined as the product of the number of sick days, average daily earnings and the percentage of accrual, depending on the length of service of the employee.

Average earnings in the calculation of sick leave payment in 2017

The average daily earnings in the sick leave calculation are determined on the basis of the two calendar years preceding the year in which the disability episode occurred. All payments to the employee that took place in these two years, and which at the same time were included in the calculation base for the payment of insurance premiums in case of temporary disability, are taken into account. Moreover, if the employee was hired during these two years, and before that he worked in another place, then the data from the current employer will be incomplete. How to calculate sick leave in this case? When calculating average earnings, a new employer will have to focus on a certificate of the amount of payments subject to contributions to the FSS, issued by the employee's previous employer. The form of this certificate was approved by order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n.

You also need to remember that the total amount of earnings, which is taken to calculate the average, is limited by the upper limit. This figure increases slightly every year. So in 2015 and 2016, the maximum earnings for calculating insurance premiums were 670,000 rubles and 718,000 rubles, respectively. In 2017, this figure is 755,000 rubles: within this amount of wages, from January and on an accrual basis, insurance premiums are calculated this year in case of temporary disability. But to determine the average earnings in the calculation of the sick leave, 2017 does not yet matter. The limit on it will be relevant only in 2018.

How to calculate the "hospital" experience

The percentage of average earnings, according to which sick leave is calculated, depends on the number of years of insurance experience. 100% of payments are received by those employees whose experience is 8 years or more. With an experience of 5 to 8 years, the employee benefit will be calculated based on 80% of average earnings. With an experience of up to 5 years, a limit of 60% applies.

These indicators are taken into account if sick leave in 2017 is calculated for various diseases, injuries, when treating a child in a hospital, as well as during quarantine, aftercare in a sanatorium, with medically justified prosthetics, or if it is necessary to care for a sick relative who is undergoing treatment outpatient.

Other limits are provided for caring for a child who is being treated outside the hospital: for the first 10 calendar days, the average earnings are calculated depending on the length of service according to the rules described above, for the following days, the sick leave is calculated based on 50% of the average earnings (clause 1, part 3 article 7 of the Federal Law of December 29, 2006 No. 255-FZ).

A separate limit on average earnings - 60% - is provided for cases when an employee who has already quit, who falls ill or is injured within 30 days from the date of dismissal, applies for benefits to the employer (part 2 of article 7 of the Federal Law of December 29, 2006 No. 255-FZ).

Calculation of sick leave in 2017: example 1

Ivanov T.S. was absent from work from 17 to 27 July. During these 11 days, he provided the employer with a sick leave.

The total amount of earnings in 2016 from this employer amounted to 810,000 rubles (that is, it exceeded the threshold for calculating contributions to the FSS), in 2015 - 350,000 rubles. At the same time, at the beginning of 2015, this employee was in an employment relationship with another employer, and according to a certificate from the previous place of work, his income subject to insurance contributions for the first months of 2015 amounted to 218,500 rubles.

The total work experience of this employee is 7 years.

(718,000 + 350,000 + 218,500) / 730 x 80% x 11 = 15,508.50 rubles.

Example 2

Smirnova V.A. provided the employer with a sick leave certificate for child care for the period from July 24 to August 3.

The earnings of this employee in 2016 will be 560,000 rubles, in 2015 - 512,000 rubles. Work experience - less than 5 years.

The calculation of the sick leave will look like this:

(560,000 + 512,000) / 730 x 60% x 11 + (560,000 + 512,000) / 730 x 50% x 1 = 9545.21 rubles.

Minimum wage for calculating sick leave in 2017

How to calculate sick leave in 2017 if the employee had no income in the previous two years, for example, he just started his career? In this case, the sick leave will be calculated based on the minimum wage in force on the date of the onset of disability (Article 14 of the Federal Law of December 29, 2006 No. 255-FZ).

Until July 1 of this year, the minimum wage in Russia was 7,500 rubles, after this date the figure increased to 7,800 rubles.

An example of calculating sick leave in 2017 based on the minimum wage:

Petrov A.V. got a first job in 2017, provided his employer with a sick leave for the period from July 28 to August 3.

The calculation of sick leave for this situation will be performed as follows:

7,800 x 24 / 730 x 60% x 7 = 1,077.04 rubles.

How employers pay for sick leave

The above principles of how the sick leave is calculated are sufficient for the employee to independently determine the amount of the payment due to him. However, the employer needs to take into account one more point related to the reimbursement of temporary disability benefits. So, if we are talking about ordinary cases of illness or injury, as well as in the case of an induced abortion or IVF procedure, the sick leave for the first 3 days is paid to the employee at the expense of the employer. Social insurance does not compensate these amounts, but compensates for the entire remaining period of the sick leave, starting from the 4th day. For all other cases of calculating sick leave, the allowance is paid at the expense of the FSS, starting from the 1st day indicated on the disability certificate.

SAINT PETERSBURG AND LENIGRAD REGION:

REGIONS, FEDERAL NUMBER:

Making a sick leave is a complex procedure that requires knowledge of a number of legislative nuances. An accountant and a personnel specialist are engaged in the preparation of documents. The procedure and rules for paying sick leave in 2017 did not change significantly.

Who can receive benefits?

The sick leave benefit is due to:

- citizens of Russia;

- foreigners residing in the country (permanently or temporarily);

- stateless persons.

Please note that the payment of hospital employees who work under the contract is not provided. The disability certificate by order No. 624 is issued from the first day of performance of official duties in the case of official employment, including during the probationary period. The relevant provisions can be found in Art. 2 No. 255-FZ of December 29, 2006.

The basic procedure for sick leave payments in 2017

There will be changes in sick leave payments in 2017, but not significant. At the same time, there is no fixed value for the temporary disability certificate, since it depends on the length of service and earnings:

- with a minimum length of service (less than 5 years), 60% of the total salary is due;

- specialists with 5-8 years of experience receive 80%;

- with more than 8 years of service, the allowance is paid at a rate of 100%.

The maximum and minimum sick leave in 2017 is regulated at the legislative level. The maximum is 1,901.37 rubles. and the minimum is 246.58 rubles.

Settlement procedure

Let's figure out how sick leave is paid in 2017:

- the average earnings for the period under review are determined;

- average daily earnings are calculated;

- the amount of the daily allowance is calculated;

- the amount of the benefit to be paid is determined.

The calculation of sick leave payment in the event that the average amount of earnings exceeds the maximum is made taking into account the maximum amount (indicated above). Earnings are taken over the last two years. Is the employee new to the company? Get information from your previous job.

Insurance experience is less than six months? In this case, one minimum wage is provided for each month. To determine the total amount of the temporary disability sheet, multiply the amount of one daily allowance by the number of days according to the information on the sick leave.

Good to know. In 2017, it is possible to issue electronic sick leave certificates, which was not possible before.

Supplement to average earnings - how is it done

In some organizations, an additional payment is made up to the average earnings on a sick leave. This allowance is only for persons with a certain work experience. The Social Insurance Fund limits the amount of payments - it is 901.37 rubles per day. At the same time, the employer is not prohibited from making additional payments up to the average amount of earnings on a temporary disability sheet for the missing amount.

Important. Surcharge is the right of the employer, but not the obligation.

Additional payments come from the employer, and not from the state, therefore they are subject to income tax. The tax amount is calculated in the standard way.

Who is eligible for the allowance

Order 347n on approving the form of a disability sheet provides for the payment of benefits upon the occurrence of such insured events:

- illness, injury of the employee himself;

- quarantine of the worker or his child under the age of seven;

- caring for a sick family member;

- prosthetics for medical indications;

- post-treatment in sanatorium conditions.

Accidents, compensation for occupational diseases are made from the FSS in the standard manner.

How long is sick leave for?

The maximum number of sick leave days issued by one doctor to one employee is 30 days. Wherein:

- a medical commission can issue sick leave for up to 9-12 months with a favorable prognosis, with monthly medical commissions;

- for caring for a child under 7 years old, a sick leave is issued for the required number of days, up to 15 years old - 2 weeks, over 15 years old - 3 days;

- for pregnancy, childbirth, sick leave is issued for 140 days if there is one child, and for 194 days (this is the maximum) if there are more than one child;

- for the care of an incompetent, sick relative (only after the conclusion of a doctor) only 7 days are paid.

How many days per year is paid sick leave? If the employee was sick himself, then everything (but there are exceptions), if he cared for the child, then up to 120 days. Only 30 days a year are allocated to look after a sick relative.

In order to normally receive money for sick leave, a certificate for calculating sick leave must be issued within six months. If you have not previously worked, the allowance will be paid, but the calculation will be made from the minimum wage. In case of illness, within 30 days after the dismissal, the former employer is obliged to pay 60% of the average earnings.

A certificate of the amount of earnings can be requested from the territorial body of the PFR. If a certificate for sick leave 182n was provided on time, the allowance must be paid along with the next payment (salary or advance payment). The law provides for situations when benefits are not paid - specify.

Unauthorized salary accrued by an accountant is not subject to insurance premiums

If the chief accountant regularly transferred to himself a salary in a larger amount than specified in the employment contract, the amounts of such an excess are not included in the contribution base.

Electronic Claims for Taxes and Contributions: New Referral Rules

Recently, the tax authorities have updated the forms of claims for payment of debts to the budget, incl. on insurance premiums. Now the time has come to correct the procedure for sending such requirements to the TMS.

Pay slips do not need to be printed.

Employers do not have to give employees pay slips on paper. The Ministry of Labor does not prohibit sending them to employees by e-mail.

"Physicist" transferred payment for the goods by bank transfer - you need to issue a check

In the case when an individual transferred to the seller (company or individual entrepreneur) payment for the goods by bank transfer, the seller is obliged to send a cash receipt to the buyer-physicist, the Ministry of Finance believes.

The list and quantity of goods at the time of payment is unknown: how to issue a cash receipt

Read also: Application for a salary certificate

Name, quantity and price of goods (works, services) - mandatory details of a cash receipt (SRF). However, when receiving an advance payment (advance), it is sometimes impossible to determine the volume and list of goods. The Ministry of Finance told what to do in such a situation.

Medical examination for working at a computer: mandatory or not

Even if an employee is busy working with a PC for at least 50% of the working time, this in itself is not a reason to regularly send him for medical examinations. Everything is decided by the results of certification of his workplace according to working conditions.

Changed the operator of electronic document management - inform the Federal Tax Service

If an organization has abandoned the services of one electronic document management operator and switched to another, it is necessary to send an electronic notification of the recipient of documents to the tax office via TCS.

Sick leave since 2017: changes

Let's talk about what changes in the calculation of sick leave must be taken into account in 2017.

Maximum allowance

When calculating the average earnings for temporary disability benefits, it must be remembered that the amount of earnings taken into account for a calendar year cannot be more than the maximum value of the base for calculating insurance premiums to the FSS (part 3.2 of article 14 of the Federal Law of December 29, 2006 No. 255- FZ).

Recall that the average daily earnings are calculated for the previous 2 calendar years (part 1 of article 14 of the Federal Law of December 29, 2006 No. 255-FZ). This means that for sick leave in 2017, such years will be 2015 and 2016.

The marginal bases for calculating insurance premiums to the FSS for these years were 670,000 rubles and 718,000 rubles, respectively. This means that the maximum daily allowance for temporary disability (with the payment of benefits in the amount of 100% of average earnings) in 2017 is 1,901.37 rubles ((670,000 +718,000) / 730).

By the way, for sick leave accrued in 2016 (the billing period was then 2014-2015), the maximum amount of daily allowance (when paid based on 100% of average earnings) was 1,772.60 ((624,000 + 670,000) / 730) .

Sick leave from the minimum wage

The temporary disability benefit is calculated on the basis of the minimum wage established on the day of the insured event, under the following circumstances (part 1.1 of article 14 of the Federal Law of December 29, 2006 No. 255-FZ. Letter of the FSS of December 14, 2010 No. 02-03-17 / 05-13765):

- if the employee had no earnings for the billing period;

- if the average earnings calculated for the specified period, calculated for the full calendar month, are lower than the minimum wage on the day of the insured event.

The benefit from the minimum wage for sick leave that came in 2017 before July 1 is 246.58 (24 * 7500/730).

And considering that from 07/01/2017 the minimum wage is set at 7,800 rubles (Article 1 of the Federal Law of December 19, 2016 No. 460-FZ), the daily allowance in the case of calculating sick leave taking into account the minimum wage for employees July, will be 256.44 rubles (24*7800/730).

Also read:

The maximum amount of sick leave in 2017

The maximum amount of sick leave in 2016-2017 determined based on several parameters. And although the calculation methodology as a whole has not changed, the minimum and maximum payments vary compared to previous years due to changes in the indicators used. How to calculate sick leave for pregnancy and childbirth in 2017 - you will learn about it from this article.

Key points when calculating sick leave in 2016-2017

There are 2 blocks of main points that you need to know before starting the calculation.

1st block - initial calculation parameters

1. Who pays sick leave:

- by illness and injury (non-production):

- the first 3 days - by the employer;

- subsequent days - from the FSS budget;

- for other reasons:

- for the entire period - from the FSS budget.

2. To whom sick leave is paid:

- employees under an employment contract;

- recipients of funds from which contributions to the FSS are paid.

Important! Foreign citizens temporarily staying in Russia and working in Russian organizations are also entitled to a sick leave payment if they have an employment contract and payment by the employer (insured) of contributions for a foreigner to the FSS within 6 months before the month when disability occurred (Article 2 of the Federal Law " On compulsory social insurance in case of temporary disability and in connection with motherhood” dated December 29, 2006 No. 255-FZ).

3. How sick leave is paid.

Paid calendar days of disability (indicated in the sick leave). An exception (under Article 9 of Law No. 255-FZ) is the periods:

- downtime;

- suspension from work;

- other exemption from work with full or partial compensation, except for the annual basic leave;

- the employee's stay in custody or arrest;

- conducting judicial and medical examinations.

2nd block - indicators for calculation

1. Percentage of earnings depending on the length of service. The maximum amount of sick leave in 2016-2017 limited to the following numbers.

Length of service (during which insurance premiums were paid), in years

Important! If disability has occurred as a result of an occupational disease or an emergency at work, 100% of earnings are immediately taken into account. In this case maximum sick pay limited to 4 times the amount of the monthly insurance payment in the FSS (Article 9 of the Law "On Compulsory Social Insurance against Industrial Accidents and Occupational Diseases" dated July 24, 1998 No. 125-FZ).

Restrictions on payments by seniority do not apply to sick leave for pregnancy and childbirth.

Read more about the calculation and payment of sick leave for pregnancy and childbirth in the material "The maximum amount of temporary disability benefits - 2016" .

2. Calculation period. It is 2 years before the sick leave period. Includes all payments from which contributions to the FSS were accrued, including from other employers (Article 14 of Law No. 255-FZ).

3. Divisor to get the average daily earnings. For sick leave, the indicator 730 (365 + 365) is always used.

Read about the taxation of the amount of hospital personal income tax in the article “Is the sick leave (sick leave) subject to personal income tax?” .

The minimum amount of payment for sick leave in 2017

The amount of average earnings calculated according to the main methodology for the period of disability must be tried on to the minimum indicator. This is usually necessary in cases where the sick employee for some reason did not work 2 years before the sick leave and the amount of the monthly allowance may turn out to be less than the established minimum wage.

Read also: Employment contract with a foreign citizen under a patent sample 2020

If the calculation for average earnings is less than the calculation for the minimum wage, it is necessary to calculate the sick leave payment based on the minimum wage

Important! From 07/01/2016, the minimum wage is 7,500 rubles. And from 07/01/2017 it increases to 7,800 rubles.

The maximum amount of sick leave in 2017

Maximum sick pay sheet in 2017 is limited by the maximum value of the base for calculating insurance premiums in the FSS. The value is annually established (indexed) by decrees of the Government of the Russian Federation and characterizes the maximum amount with which contributions to the FSS can be paid for the year. Thus, the FSS cannot pay benefits in excess of this limit (does not receive contributions for this).

In practice, this looks like a second fitting of the result of the original calculation of average earnings, but now to the maximum amount of sick leave. which is compensated by the FSS.

The contribution amount was:

- in 2015 - 670,000 rubles;

- in 2016 - 718,000 rubles.

So, in 2017, the indicator of average daily earnings for calculating maximum sick pay can't be more:

(670 000 + 718 000) / 730 = RUB 1,901.37

The procedure for calculating sick pay - 2017 by example: how to calculate sick leave for pregnancy and childbirth

The employee was admitted to the organization under an employment contract on 07/01/2016. This is his first job. The employee's salary is 28,000 rubles. In December, he was paid a year-end bonus in the amount of his salary. On January 15, 2017, the employee went on maternity leave.

- The average earnings for 2 years (January - December 2015 + January - December 2016) amounted to 196,000 rubles. This means that the average daily wage is 268.49 rubles. (196,000 / 730).

- Let's determine how much the average daily wage at the minimum wage will be:

7,500 × 24 / 730 = 246.58 rubles

Minimum wage calculations were not required. We accept as a basis a more profitable option for the employee.

Important! If the experience is less than 6 months, the calculation is done only according to the minimum wage.

- Compare the average cost of the day with the maximum:

RUB 268.49< 1 901,37 руб.

She is less than maximum amount of sick leave in 2017 according to the maximum value of the base of insurance premiums (1,901.37 rubles).

4. The maximum amount of sick leave. which an employee can count on:

140 (calendar days) × 268.49 = RUB 37,588.60

Maximum period of sick leave

Speaking of maximum sick pay in 2017. it is impossible not to recall the 2nd part of the final calculation formula - the duration of the illness period in calendar days. Sick leave is issued according to strictly regulated rules for a period established by law.

The most common maximum terms are:

- For outpatient treatment - 15 days inclusive.

- In case of inpatient treatment - the period of stay in the hospital plus up to 10 days inclusive after the hospital on an outpatient basis.

- With continued treatment in sanatorium-type institutions - 24 days inclusive.

Important! If the illness (injury) is related to the professional activity of the sick person, the time of travel to the medical institution and back is included in the sanatorium sick leave.

- For pregnancy and childbirth - 140-196 days (depending on the situation).

- Caring for a sick child:

- up to 7 years - for the entire period of the disease;

- from 7 to 15 years - for 15 days inclusive;

- older than 15 years with outpatient treatment - for 3 days.

Important! Standard terms of treatment can be extended, but only by decision of a special medical commission.

The maximum amount of sick leave in 2017 limited:

- a limited indicator of average daily earnings according to the maximum value of the base for contributions to the FSS - 1,901.37 rubles / day;

- limited duration of sick leave in days (for a standard case of staying at home due to a "common" illness - no more than 15).

That is, in a normal situation maximum sick pay in 2017 it cannot be more than 15 × 1,901.37 = 28,520.55 rubles.

The maximum size and term of sick leave in 2017

How long can a disability certificate last?

Only the attending physician determines how long a person needs to recover. Usually the terms are short - from several days to several weeks. But sometimes it takes longer to heal. To find out the maximum sick leave period in 2017, personnel officers should familiarize themselves with the Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 N 624n. who introduced the rules for issuing disability certificates.

This document says:

- in connection with an injury, poisoning or illness, a citizen can be treated for up to 12 months;

- if the cause of poor health is pregnancy and the upcoming birth, it is not necessary to wait for the employee earlier than after 140 days;

- women who decide to adopt someone else's child are given sick leave for up to 70 calendar days;

- parents caring for a sick disabled baby (under 15 years old) can ask for a temporary disability certificate lasting 120 days.

But in normal situations, sick leave lasts up to 15 days. An extension of the term is possible only in agreement with the commission of doctors. Moreover, both public and private clinics work according to the same rules, therefore, without good reasons, an employee will not be able to stay away from work for a long time.

Does the maximum sick leave in 2017 depend on its duration

The longer an employee is sick, the higher the temporary disability benefit will be. But the maximum amount of sick leave in 2017, according to the law, depends not only on the number of days of illness, but on other factors, namely, on the length of service of the employee and the maximum base for calculating insurance premiums for social insurance in specific periods.

So, the maximum sick leave payment in 2017 is considered based on the limit values of 2015 and 2016. - 670 thousand and 718 thousand rubles, respectively. The maximum daily earnings, taking into account these indicators, will be: (670,000 + 718,000) / 730 = 1901.37 rubles, where 730 is the number of days in the previous two years.

1901.37 rubles is the maximum amount for one day of illness that an employee whose experience exceeds 8 years can count on.

For an employee with an experience of 5 to 8 years, the upper limit of the allowance is less - 1901.37 x 80% = 1521.1 rubles, since this category of workers is entitled to only 80% of earnings.

If an employee, according to the work book, has worked for less than 5 years, then he is entitled to an allowance in the amount of 60% of daily earnings. In this case, the maximum that he can receive for a day of illness is 1140.82 rubles (1901.37 x 60%).

The final amount, of course, will depend on the number of days of illness.

2018-02-14

Temporary disability, confirmed by a sheet from a medical facility, is payable. The employee receives sick leave. The online calculator located at the beginning of the article will help you calculate the amount of the payment. The calculator is easy to use, just fill in three fields and select the amount of insurance experience. The calculation is carried out online immediately after filling out the form. If there are questions about the correctness of the calculations, we suggest reading the article below, which discusses the rules for calculating sick leave in 2017 in a new way.

In the online calculator, you can specify the duration of the insurance period, 4 options are given to choose from. The default is less than six months.

|

Step 2 |

Calculate income for the estimated period |

The rules for calculating sick leave in 2017 require calculations to be made for a period equal to two years before the year the sick leave was opened.

To calculate income, you need to add up the salary for all months of each year. Those payments that were subject to insurance premiums should be taken into account. If the employer does not calculate the contribution to VNiM from the income received, then it does not need to be taken into account.

The calculator has 2 fields for this purpose, for each year from the estimated period you need to separately enter the amount of wages. When filling in these fields on the online calculator, do not indicate amounts exceeding the contribution base limits (670,000 and 718,000).

The number of sick days can be found on the temporary disability sheet (under the line “release from work.” The payment of benefits is due for each such day. The first three days are paid by the employer from their own funds, the next ones are also first paid by the employer, later compensated by the FSS.

In the online calculator, this indicator fits into the "period of incapacity for work" field.

The formula looks like:

P \u003d (ZP for 2 years / 730) *% of payment * Days of sick leave

An example of calculating disability benefits in 2017

The employee brought a certificate of temporary disability for the period from September 21 to September 28, 2017. Insurance experience is 7 years. Her earnings in 2015 320000 rubles, 2016 — 430000 r. We will calculate the allowance taking into account the formulas given above, as well as in the online calculator.

- % payment for 7 years - 80%

- Total biennial income = 750,000 p.

- Number of sick days = 9

- P \u003d 750000 / 730 * 80% * 9 \u003d 7397.26 rubles.

In the online calculator, the calculation looks like this:

How to calculate the insurance period for sick leave

The calculation rules are as follows - the entire period of work under an employment contract is taken, according to the work book. The time of service in the army on a military ID is also taken into account.

Step 1 - complete years are summed up;

Step 2 - the full months not taken into account in Step 1 are summed up;

Step 3 - the remaining days in partial months are summed up;

Step 4 - the indicator from Step 3 is converted into full months (every 30 days is a month) and summed up with the value from Step 2;

Step 5 - The figure from Step 4 is converted to full years (every 12 months is 1 year).

The result of the calculation must be expressed in years and months.

In the online calculator, when calculating sick leave, it is enough to select the desired experience.

See also the procedure for calculating the insurance period.

An example of calculating seniority:

Periods of work of an employee according to the work book:

- from 03/10/2005 to 10/18/2008 - the first employer;

- from 12/10/2008 to 02/15/2014 - the second employer;

- from 03/02/2014 to present - current employer.

The calculation is carried out on 01.10.2017:

Step 1 - in the first period - 2 full years, in the second - 5, in the third - 2. Total 9 years.

Step 2 - in the first period - 18 full months, in the second - 1, in the third - 18. Total 37 months.

Step 3 - in the first period - 40 days, in the second - 37, in the third - 30. Total 107 days.

Step 4 - 107 days this is 3 months, 17 days are thrown back. 3 months add up with 37. Total 40 months.

Step 5 - 40 months - this is 3 years 4 months.

Step 6 — insurance experience 12 years 4 months.

How has the billing period changed? What is the earnings limit for benefit calculation? How many calendar days are in the billing period? What is the maximum average daily wage? What is the maximum benefit amount? When are benefits calculated based on the minimum wage?

Here comes the new billing period. In the article we will tell you what you need to pay attention to when calculating benefits from 01/01/2017, what indicators for calculating benefits for temporary disability, maternity, child care have changed and what are the maximum benefits in 2017.

Recall that the calculation of benefits for temporary disability, for pregnancy and childbirth, for child care is carried out on the basis of the following regulatory documents:

Federal Law No. 255-FZ of December 29, 2006 “On Compulsory Social Insurance in Case of Temporary Disability and in Connection with Motherhood” (hereinafter referred to as Federal Law No. 255-FZ);

Federal Law No. 81-FZ of May 19, 1995 “On State Benefits for Citizens with Children” (hereinafter referred to as Federal Law No. 81-FZ);

Regulations on the specifics of the procedure for calculating benefits for temporary disability, for pregnancy and childbirth, monthly childcare benefits for citizens subject to compulsory social insurance in case of temporary disability and in connection with motherhood, approved by Decree of the Government of the Russian Federation dated June 15, 2007 No. 375 (hereinafter - Regulation No. 375).

The procedure for calculating benefits in 2017 remained the same, but the indicators that must be applied have changed. So, since 01/01/2017, the following indicators have changed:

- billing period;

- payment limit;

- the number of calendar days in the billing period;

- maximum average daily earnings;

- maximum allowance.

Let's consider each of them in more detail.

Settlement period.

According to Part 1 of Art. 14 of Federal Law No. 255-FZ, monthly maternity benefits are calculated based on the average earnings of the insured person, calculated for two calendar years preceding the year of maternity leave, parental leave. Thus, if the insured event occurred in 2017, the billing period will be 2015 and 2016.

At the same time, it is worth remembering that if in two calendar years immediately preceding the year of occurrence of the specified insured events, or in one of the above years, the insured person was on maternity leave and (or) parental leave, then the corresponding calendar years (calendar year) at the request of the insured person may be replaced for the purpose of calculating average earnings by previous calendar years (calendar year), provided that this leads to an increase in the amount of the benefit (clause 11 of Regulation No. 375).

Note:

The replacement of calendar years that are used to calculate the average earnings for calculating benefits may be carried out not for any years (year) at the choice of the insured person, but for the years (year) immediately preceding the years in which the insured person was on maternity leave and childbirth and/or parental leave. Such clarifications are provided in the letters of the FSS of the Russian Federation of November 30, 2015 No. 02-09-11 / 15-23247, the Ministry of Labor of the Russian Federation of December 9, 2015 No. 17-1 / OOG-1755.

Taking into account the above provisions of the legislation and the explanations of the FSS employees, the following conclusions can be drawn. If the insured event occurred in 2017, but the insured person:

1) was on maternity leave and/or parental leave in 2015-2016, these years can only be replaced by 2013-2014;

2) wholly (in 2014 and 2015) and partially (in 2016 and 2013) was on maternity and parental leave, all of the above years may be replaced by the calendar years immediately preceding the years in which the insured the person was on the named holidays, that is, for 2011 and 2012. Or, earnings for 2016 and 2013 can be taken into account, while periods of temporary disability are excluded from the number of calendar days in the billing period (730 or 731, if the year was a leap year) for calculating the maternity allowance and the monthly allowance for child care , maternity leave, parental leave, in some cases - periods of release from work with full or partial pay, if it was not charged (part 3.1 of article 14 of Federal Law No. 255-FZ);

3) was on maternity leave and parental leave from November 2012 to July 2017, and until November 2012 partly worked, the calculation period at the request of the insured person may be shifted to 2010 and 2011, or the calculation may be earnings for 2012 (where the insured person partially worked) and 2011 are taken based on which option the amount of the benefit will be larger;

4) was on maternity and parental leave in 2016, 2015, worked in 2014, and was also on maternity and parental leave in 2013 and 2012, the calculation period for the application of the insured person may be shifted to 2014 and 2011.

Note:

Change of years of the billing period, if the years (year) of the billing period consist (consists) of excluded periods, is the right of the insured person, not the obligation. In addition, the replacement of the years of the billing period is carried out only if the amount of the benefit is increased.

Earning limit for calculating benefits.

As already mentioned, benefits are calculated based on average earnings. At the same time, according to part 2 of Art. 14 of Federal Law No. 255-FZ, the average earnings, on the basis of which benefits for temporary disability, pregnancy and childbirth, and the monthly allowance for child care are calculated, include all types of payments and other remuneration in favor of the insured person, on which insurance premiums are accrued in FSS in accordance with Federal Law No. 212-FZ (for the period up to December 31, 2016 inclusive) and (or) in accordance with the legislation of the Russian Federation on taxes and fees (starting from January 1, 2017). At the same time, this average earnings is taken into account for each calendar year in an amount not exceeding the amount established in accordance with the rules of Federal Law No. 2017) for the corresponding calendar year, the maximum base for calculating insurance premiums to the FSS (part 3.2, article 14 of Federal Law No. 255-FZ).

Thus, if temporary disability, maternity or parental leave occurred in 2017, the calculation period will include 2015 and 2016. In this regard, the maximum amount of earnings taken into account when calculating the above benefits will be 1,388,000 rubles. (670,000 + 718,000), where:

- RUB 670,000 - the maximum value of the base for calculating insurance premiums to the FSS in 2015, established by Decree of the Government of the Russian Federation No. 1316;

- RUB 718,000 - the maximum value of the base for calculating insurance premiums to the FSS in 2015, established by Decree of the Government of the Russian Federation No. 1265.

Note:

On January 1, 2017, Decree of the Government of the Russian Federation No. 1255 came into force, which states that the maximum base for calculating insurance premiums to the Social Insurance Fund in case of temporary disability and in connection with motherhood in relation to each individual is an amount not exceeding 755,000 rubles.

The number of calendar days in the billing period.

Temporary Disability Allowance.

In accordance with Part 3 of Art. 14 of Federal Law No. 255-FZ, the average daily earnings for calculating temporary disability benefits are determined by dividing the amount of accrued earnings for the period specified in Part 1 of this article by 730. This means that when calculating this benefit, the number of days in the billing period is always the same and equals 730.

Maternity allowance, monthly allowance for child care.

According to part 3.1 of Art. 14 of Federal Law No. 255-FZ, the average daily earnings for calculating the above benefits are determined by dividing the amount of accrued earnings for the period specified in Part 1 of this article by the number of calendar days in this period, with the exception of calendar days falling on:

- for periods of temporary disability, maternity leave, parental leave;

- for the period of the employee’s release from work with full or partial pay in accordance with the legislation of the Russian Federation, if insurance premiums to the Social Insurance Fund were not charged for this period in accordance with Federal Law No. 212-FZ (for the period up to December 31, 2016 inclusive) and (or) the norms of the legislation of the Russian Federation on taxes and fees (starting from January 1, 2017).

By virtue of the above provisions of the legislation and taking into account the peculiarity of a leap year, which is 366 calendar days, when calculating these benefits, the calculation period may be:

- 730 calendar days;

- 731 calendar days if one year of the billing period is a leap year;

- 732 calendar days when replacing the calendar years (calendar year) provided for by law with a leap year (leap years).

Maximum average daily earnings.

Part 3.3 of Art. 14 of Federal Law No. 255-FZ provides: the average daily earnings for calculating maternity benefits, monthly childcare benefits, determined in accordance with Part 3.1 of this article, cannot exceed the amount calculated by dividing by 730 the sum of the limit values bases for calculating insurance premiums to the FSS established in accordance with the rules of Federal Law No. 212-FZ (for the period up to December 31, 2016 inclusive) and (or) the norms of the legislation of the Russian Federation on taxes and fees (starting from January 1, 2017) for two calendar years preceding the year of maternity leave, parental leave.

Thus, the maximum value of the average daily earnings for calculating benefits in 2017 will be 1,901.37 rubles. (1,388,000 rubles / 730 calendar days).

Maximum allowance.

Benefit for pregnancy and childbirth.

Part 1 of Art. 10 of Federal Law No. 255-FZ, it is established that the maternity benefit is paid to the insured woman in total for the entire period of maternity leave of 70 (in the case of multiple pregnancy - 84) calendar days before childbirth and 70 (in the case of complicated childbirth - 86 , at the birth of two or more children - 110) calendar days after childbirth. At the same time, this allowance is paid in the amount of 100% of average earnings (part 1 of article 11 of Federal Law No. 255-FZ).

Therefore, the maximum amount of maternity benefit in 2017 will be:

- with normal childbirth - 266,191.80 rubles. (1,901.37 rubles x 140 calendar days x 100%);

- with multiple pregnancy - 368,865.78 rubles. (1,901.37 rubles x 194 calendar days x 100%);

- with complicated childbirth - 296,613.72 rubles. (1,901.37 rubles x 156 calendar days x 100%).

Monthly allowance for child care.

In accordance with Part 1 of Art. 11.2 of Federal Law No. 255-FZ, a monthly child care allowance is paid in the amount of 40% of the average earnings of the insured person, but not less than the minimum amount of this benefit provided for by Federal Law No. 81-FZ. The average earnings for calculating this allowance is determined by multiplying the average daily earnings, established in accordance with Parts 3.1 and 3.2 of Art. 14 of Federal Law No. 255-FZ, by 30.4 (part 5.1 of this article). Consequently, the maximum monthly allowance for child care in 2017 will be 23,120.66 rubles. (1,901.37 rubles x 30.4 x 40%).

Note:

Indexation of the minimum monthly allowance for child care, which must be carried out on the basis of Art. 4.2 of Federal Law No. 81-FZ, since January 1, 2017, there was no such indexation coefficient, since legislators did not provide for such an indexation coefficient. However, this allowance must be indexed from February 1, 2017, taking into account the consumer price index for 2016. In this regard, from January 1 to February 1, 2017, benefits should be paid in the same amounts as in 2016. Recall that from February 1, 2016 (Decree of the Government of the Russian Federation dated January 28, 2016 No. 42 “On establishing the amount of indexation of payments, benefits and compensations from February 1, 2016”), the minimum monthly allowances for child care are:

- allowances for the care of the first child - 2,908.62 rubles;

- allowances for the care of the second child and subsequent children - 5,817.24 rubles.

However, Federal Law No. 164-FZ from July 1, 2016 increased the minimum wage to 7,500 rubles. In this regard, in cases where the average earnings of the insured person, calculated for the two years preceding the year of the insured event, calculated for a full calendar month, is lower than the minimum wage, the average earnings for calculating benefits for temporary disability, for pregnancy and childbirth, monthly benefits for childcare is taken equal to the minimum wage (that is, 7,500 rubles). The minimum wage is applied when calculating benefits for insured events that occurred from 07/01/2016. Recalculation of benefits for insured events that occurred before 07/01/2016 and continues after the specified date due to changes in the minimum wage is not made.

So, from 07/01/2016 the situation has changed. From this date, the minimum wage is 7,500 rubles, therefore, the allowance for caring for the first child cannot be less than 3,000 rubles. (7,500 rubles x 40%). Accordingly, from 07/01/2016, due to the increase in the minimum wage, the minimum amount of the allowance for the care of the first child has also been increased. Now it is 3,000 rubles. At the same time, the amount of the benefit for caring for the second child and subsequent children remained the same - 5,817.24 rubles.

Payment of benefits calculated on the basis of the minimum wage.

In accordance with Part 1.1 of Art. 14 of Federal Law No. 255-FZ, the average earnings, on the basis of which pregnancy and childbirth benefits are calculated, the monthly childcare allowance, is taken equal to the minimum wage established by federal law on the day of the insured event, if:

- the insured person had no earnings during the periods specified in paragraph 1 of this article;

- the average earnings calculated for these periods, calculated for a full calendar month, are lower than the minimum wage established by federal law on the day of the insured event.

A similar rule is enshrined in paragraph 11 (1) of Regulation No. 375. In addition, paragraph 20 of this provision establishes another case in which the maternity benefit is paid in an amount not exceeding the minimum wage for a full calendar month provided for by federal law, – if the insured person has an insurance period of less than six months.

From 07/01/2016, the minimum wage is set at 7,500 rubles. (Federal Law No. 164-FZ). Thus, the minimum average daily earnings for calculating benefits based on the minimum wage is 246.57 rubles. (7,500 rubles x 24 months / 730 calendar days).

In conclusion, let us once again draw your attention to the main changes that must be taken into account when calculating benefits in 2017:

- billing period - from 01/01/2015 to 12/31/2016;

- the maximum amount of earnings for calculating benefits is 1,388,000 rubles;

- the maximum value of the average daily earnings for calculating benefits is 1,901.37 rubles;

- the minimum average daily earnings for calculating benefits based on the minimum wage is 246.57 rubles.

In addition, remember that when calculating temporary disability benefits, the number of days in the billing period is always the same - 730. When calculating benefits for pregnancy and childbirth, for child care, the number of calendar days is determined as follows: number of excluded

out of it days. In this regard, the number of actual days can be equal to 730, 731 or 732, depending on whether there was (were) a leap year (s) in the billing period.

The calculation of sick leave in 2017-2018 has changed. Please note that the billing period and the amount of payments taken into account have changed, the maximum average daily earnings have increased. In order not to get confused in the calculation, look at examples on specific numbers.

The calculation of the sick leave in 2017 and 2018 is phased. The accountant determines:

- billing period; average daily earnings of an employee; insurance experience of the employee;

- the amount of the daily allowance;

- total sick pay.

Use this calculation procedure regardless of the cause of disability (illness of the employee himself, a member of his family, domestic injury, accident at work, etc.). Next, we give the calculation of the sick leave in 2017 and 2018.

Please note that the rules for calculating hospital benefits in 2017 and 2018 are different. Experts warn about this. Read the transcript of the lecture in the program "" in the course "What has changed in the calculation of benefits."

How to calculate sick leave in 2017

To calculate the sick leave in 2017, take the employee's salary for 2015 and 2016. These years are called the billing period. The formula for looks like this:

Use the same formula to calculate benefits in 2018, only take payments for a different period. For details, see the section "How to calculate sick leave in 2018".

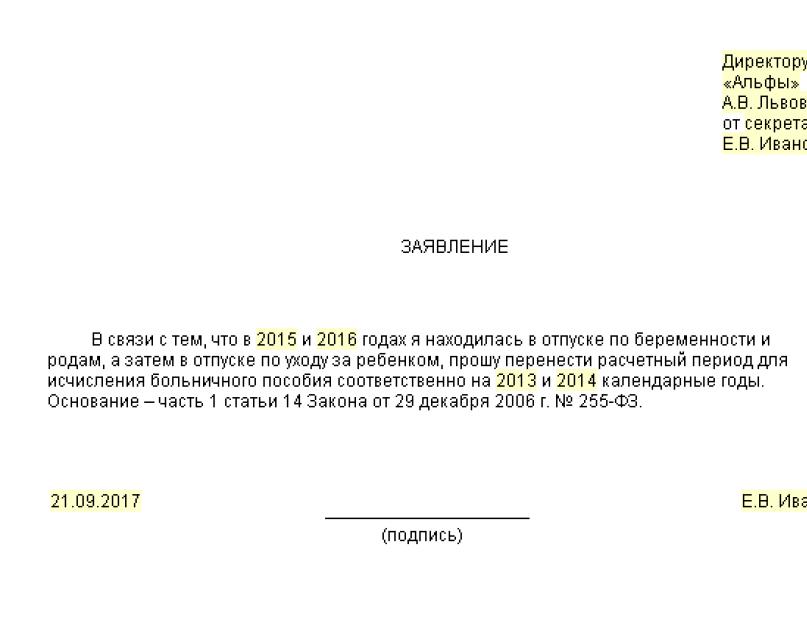

It is possible that one or both years of the billing period fell on maternity or parental leave. The employee may then replace the years of the billing period with previous years if this results in an increase in the amount of the benefit. To do this, the employee must submit an application to the employer (sample below).

According to officials, replacement years must necessarily precede the billing period (letter of the Ministry of Labor of the Russian Federation dated August 3, 2015 No. 17-1 / OOG-1105). Although Law No. 255-FZ does not establish such restrictions.

After you have determined the billing period, calculate the earnings based on which sick leave is calculated in 2017 and 2018.

Earnings for the billing period for sick leave in 2017

Include in earnings all payments for the billing period from which contributions were paid to the FSS of Russia (part 2 of article 14 of Law No. 255-FZ, clause 2 of the provision approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375).

Accordingly, all payments that are not subject to insurance premiums must be excluded from the total amount of the employee's earnings for the billing period (part 2 of article 14 of the Law of December 29, 2006 No. 255-FZ). In particular, these are:

- state benefits;

- statutory compensation payments to employees;

- financial assistance not exceeding 4000 rubles. per year per person.

A complete list of payments exempt from insurance premiums is given in Article 9 420 of the Tax Code of the Russian Federation. For example, they do not impose insurance premiums on payments under civil law contracts, on the purchase of property or property rights. For more information on this, see the recommendation "".

Compare the payments in each of the years of the billing period with the marginal contribution base. For convenience, information about the limits on contributions, we have presented in the table below.

Table. Limit values of the base for the calculation of social contributions

If in some year the total earnings exceeded the limit of insurance payments, then take this limit value to calculate the sick leave. Everything above, for this year, do not take into account.

Example:

P.A. Bespalov has been with the organization since August 2006. His salary is 15,000 rubles. From February 3 to February 24, 2015, Bespalov was on vacation. In February, he received vacation pay in the amount of 10,000 rubles. and salary - 3000 rubles.

In March 2015, Bespalov received an additional payment for work on weekends in the amount of 3,182 rubles. From May 18 to May 22, 2017, Bespalov was ill, which was confirmed by a sick leave.

The calculation period for calculating benefits is from January 1, 2015 to December 31, 2016. When determining the total earnings, the accountant took into account all payments and surcharges that are subject to contributions to the FSS of Russia.

Thus, Bespalov's earnings for the billing period for the purposes of calculating the hospital allowance are:

- in 2016 - 180,000 rubles. (15,000 rubles? 12 months),

- in 2015 - 181,182 rubles. (15,000 rubles? 11 months + 10,000 rubles + 3,000 rubles + 3,182 rubles).

The amount of earnings does not exceed the limit on contributions, therefore, the calculation of the sick leave in 2017 must be carried out based on payments in the amount of 361,182 rubles. (180,000 rubles + 181,182 rubles).

The amount of payments for the billing period must be compared with the value of the 24-fold minimum wage established on the date of the onset of temporary disability. If payments for the billing period turn out to be less, then when calculating average earnings, it will be necessary to use exactly the 24-fold minimum wage (part 1.1 of article 14 of Law No. 255-FZ).

If you make a mistake in calculating benefits, there will be a debt or overpayment of contributions. To prevent this from happening, consider sick leave in. Free trial access to the program is valid for 30 days.

Average daily earnings for sick leave in 2017

The average daily earnings for calculating the sick leave in 2017 are determined based on the earnings accrued in 2015-2016. To do this, the total income is divided by 730 days. This procedure is prescribed in part 3 of article 14 of Law No. 255-FZ.

The marginal average daily earnings for benefits is 1901.37 rubles. [(670,000 rubles + 718,000 rubles) : 730 days]. If the employee earned more in the previous two years, you accrue benefits from the new maximum average earnings of 1901.37 rubles.

Example:

Employee A.S. Kondratiev was ill from 9 to 16 February 2017. The calculation period included 2015 and 2015. During this time, the employee was credited 365,000 rubles. The settlement period Kondratiev worked completely. The average daily earnings of Kondratiev is 500 rubles. (365,000 rubles : 730 days).

Total amount of sick leave in 2017

For a list of periods included in the length of service, see Article 16 of Law No. 255-FZ and paragraphs 2 and 2.1 of the Rules approved by Order of the Ministry of Health and Social Development of Russia dated February 6, 2007 No. 91.

How the insurance period of an employee affects the amount of daily allowance, we have presented in the table below.

Answered by Irina Savchenko,

Head of the Department for Monitoring the Implementation of the Calculation and Appointment of Insurance Coverage of the Department for the Organization of Insurance Payments of the FSS of Russia

“Determine the length of service on the day of the onset of temporary disability (clause 7 of the Rules, approved by order of the Ministry of Health and Social Development of 06.02.2007 No. 91). Include periods in the insurance experience ... .. "

Table. Experience for calculating sick leave in 2017 and 2018

After the amount of the daily allowance is determined, the final calculation of the sick leave in 2017 can be made. To do this, the daily allowance must be multiplied by the number of sick days.

Example:

Let's use the conditions of the previous example and assume that Kondratiev's employee has more than 8 years of experience. Accordingly, the sickness benefit is 4,000 rubles. (500 rubles x 100% x 8 days).

Calculation of sick leave in 2017 upon dismissal

The employer must pay for the entire period of illness of the retired employee. A common mistake: organizations pay sick leave to former employees based on their length of service. And only within 30 days after the dismissal. And it should be the other way around.

If a former employee falls ill within 30 calendar days from the date of dismissal, he needs to pay for the entire period of illness (clause 2, article 5 of Law No. 255-FZ). Even if he fell ill on the 30th day. At the same time, the amount of the allowance for a former employee is 60 percent of his earnings, regardless of the length of service (clause 2, article 7 of Law No. 255-FZ).

Example:

Petrov S. A. resigned from Vector LLC on February 27, 2017. On March 24, he fell ill and was on sick leave for 7 calendar days. The settlement period is 2015 - 2016. The worker has more than 10 years of service, but still the amount of the benefit will not exceed 60 percent of his average earnings.

Petrov earned 780,013.15 rubles in 2015, and 852,746.88 rubles in 2016, which is more than the limits for 2015 and 2016. This means that the amount of the benefit will be equal to 7985.75 rubles. [(670,000 + 718,000) : 730 days ? 60%? 7 days].

How to calculate sick leave in 2018

It is necessary to calculate the sick leave in 2018 in a new way. The fact is that in 2018 the billing period for benefits includes 2017 and 2016. Because of this, the maximum daily earnings have increased.

For 2017, payments within the limits of 755,000 rubles can be taken into account for the sick leave, and for 2016 - within the limits of 718,000 rubles. That is, the maximum average daily earnings for benefits in 2018 is 2017.81 rubles. [(755,000 rubles + 718,000 rubles) : 730 days].

Important: you can automatically determine the amount of sick leave in "". Documents for the FSS are formed at the time of calculation. You can try it for free right now.

Calculation of hospital benefits in 2018: an example

The employee was ill for five calendar days - from January 15 to January 19, 2018. The settlement period is 2016-2017. In 2016, the employee's earnings amounted to 540,500.00 rubles, and in 2017 - 587,500.00 rubles.

In the billing period, the employee was ill for 14 calendar days. But this does not affect the calculation of the sickness benefit. Earnings for two years for temporary disability benefits must be divided by 730. Therefore, the average daily earnings is 1545.21 rubles. [(540,500 rubles + 587,500 rubles) : 730 days].

The insurance experience of the employee is four years. This is less than five years, so the allowance will be 60 percent of the average earnings: 4635.63 rubles. (1545.21 rubles x 60% x 5 days).

Paid sick leave in 2017-2018

Sick leave due to illness or injury is paid from the following sources (clause 1, part 2, article 3 of Law No. 255-FZ):

- for the first three days of disability - at the expense of the employer;

- > for the rest of the days - at the expense of the FSS.

Sick leave issued in connection with caring for a sick family member, quarantine of an employee or his child attending a kindergarten, aftercare in a sanatorium on the territory of the Russian Federation after the provision of medical care in a hospital, as well as in other cases, is paid at the expense of the FSS from the first days of disability (part 3 of article 3 of Law No. 255-FZ).